Explore Our Categories

Comprehensive coverage across all aspects of business

Latest articles

Our recent publications

Essential guide to choosing a commercial contract furniture supplier

Choosing the right commercial furniture supplier can transform your workspace while ensuring regulatory compliance and b...

Essential guide to construction mats for builders and developers

The UK construction industry has embraced ground protection solutions as essential infrastructure, with the sector inves...

How thriving uk businesses navigate financial hurdles: proven strategies unveiled

Navigating the complex landscape of financial challenges UK companies confront requires tailored approaches. Key hurdles...

Key elements influencing the evolution of uk enterprises

The surge in technology adoption is reshaping UK enterprises at an unprecedented pace. Automation and artificial intelli...

Strategies for uk businesses to innovate and lead their industry

Navigating business innovation in the UK requires practical approaches tailored to local markets and sectors. Start by e...

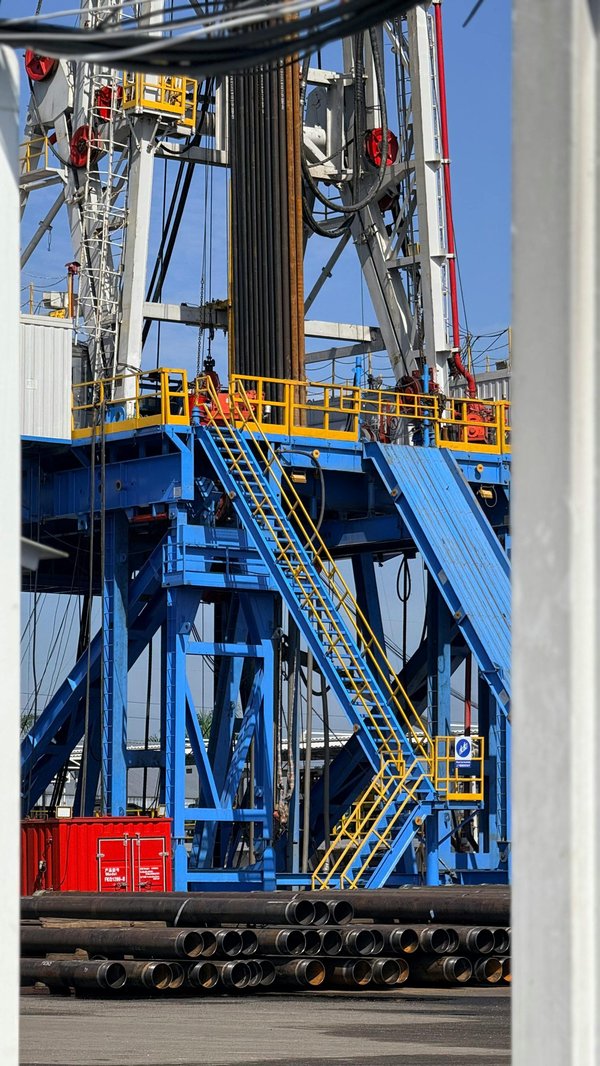

Unleashing the power of micropile oil pipeline tubes

Modern oil pipeline construction faces unprecedented challenges in unstable soil conditions and complex terrain. Micropi...

Wholesale coffee suppliers: how to source quality beans and products for your business

For café owners, office managers, and hospitality professionals, choosing the right wholesale coffee suppliers is a stra...

Understanding nrswa streetworks courses: essential training for roadwork professionals

The safety and reliability of our urban infrastructure depend on dedicated teams who maintain and upgrade roads accordin...

Unlocking success: your path to executive coach training

Executive coaching has become a strategic necessity for organisations worldwide, with the International Coaching Federat...

What Are the Common Myths About Forming a Business in the UK?

Clearing up confusion for aspiring entrepreneurs...

What are the critical steps in forming a business in the UK?

Selecting a business structure UK affects your liability, taxation, and regulatory responsibilities. The main types incl...

What Future Business Opportunities Exist for Entrepreneurs in the UK?

In today's UK business trends, the economic climate is strongly influenced by rapid technological advancement and evolvi...

Are corporate leaders liable for financial setbacks? exploring executive accountability

Understanding executive liability is crucial to grasp how legal systems hold corporate leaders responsible for financial...

Key legal hurdles every new uk business must overcome

Starting your business begins with choosing the right business structure. Your options include a sole trader, partnershi...

Unlocking the secrets of business law: ensuring your uk company's protection

Understanding UK business law principles is essential for ensuring effective company legal protection. A fundamental asp...

Adapting uk business management strategies for success in a post-pandemic era

Since the onset of the pandemic, UK business management evolution has accelerated dramatically. Companies had to rapidly...

Exploring the benefits and challenges of remote work for uk business leaders

Remote work offers several advantages that UK businesses can leverage to enhance overall performance. A primary benefit ...

Mastering month-end close : top best practices for success

A streamlined month-end close process directly impacts your company's financial accuracy and decision-making speed. Acco...

The evolving landscape of recruitment agencies: supporting job seekers and hiring managers

Securing meaningful employment or the ideal candidate has always presented challenges. Recruitment agencies are now at t...

Transform your sustainability goals with expert esg consulting

The business landscape demands strategic ESG integration, and professional sustainability consulting delivers measurable...

Unlocking sustainable growth: essential strategies for uk businesses

Sustainable growth strategies are essential for businesses aiming to thrive long-term in the UK market. To achieve susta...

How Can UK Businesses Leverage Marketing Strategies to Boost Customer Engagement?

Understanding customer engagement is crucial for UK businesses aiming to build lasting relationships. Effective marketin...

How Can UK Businesses Prevent Common Marketing Mistakes?

Navigating UK marketing mistakes requires a clear understanding of typical pitfalls. Business marketing errors often ste...

How Do UK Businesses Leverage Marketing Strategies to Boost Brand Visibility?

In the competitive landscape of UK businesses, marketing strategies UK increasingly blend integrated digital and traditi...

Unlock your brand's potential with our e-commerce agency

The e-commerce landscape demands more than just a basic online presence. According to Statista, global e-commerce sales ...

Unlocking precision: the power of brand tracker insights

Modern brands lose an average of 23% of potential revenue due to misaligned tracking strategies, according to 2024 McKin...

Exploring uk companies' strategies for thriving in global trade after brexit

Understanding the evolving landscape of UK global trade post-Brexit is crucial for any business aiming to thrive. Many U...

Finding the right industrial air compressors in the uk

...

Revitalize your space with carpet cleaning in southall

Have you ever looked around your living room and felt it just wasn't as inviting as it used to be? Over time, carpets si...

The power of 301 redirects for enhancing your website's seo

Have you ever wondered how much traffic your business loses when pages disappear or move? 301 redirects preserve your ha...

Frequently Asked Questions

How often is new content published?

We publish fresh articles multiple times per week across all categories, including business strategy, legal updates, marketing insights, and management guides. Our editorial calendar ensures consistent coverage of trending topics and foundational business concepts.

Who writes the content featured here?

All articles are researched and written by experienced business journalists and industry analysts who specialize in various domains including legal compliance, marketing strategy, financial management, and organizational development. Each piece undergoes editorial review for accuracy and relevance.

Can I access archived articles?

Yes, our complete archive of articles dating back several years remains accessible through category filters and search functionality. You can browse by topic, date, or keyword to find specific resources relevant to your interests.

Is the content suitable for both beginners and experienced professionals?

Absolutely. We maintain a balanced mix of introductory guides for those new to business concepts and advanced analyses for seasoned professionals. Each article clearly indicates its level of complexity, allowing readers to choose content that matches their expertise and learning goals.